Cash Projection

Cash Receipts Projections

Determining cash flow projections is a significant factor regarding the success of an organization. The knowledge of a client’s past behavior is the best tool for determining their future behavior and subsequent corresponding courses of action.

Many circumstances can influence a customers ability to pay, such as an economic downturn, or an unexpected event within the customers company. With this information available, staff members can make informed, intelligent decisions about client status and determine the most appropriate means of action.

However, outside of the above factors, based on the past behavior, a company can determine total inflow of the cash from your accounts receivable based on Avg. Days Outstanding, Avg. Days to Pay and Avg. Days Past Due. CollectSoft provides the ability to analyze and manage all these factors when making company projections.

- Average Days to Pay

- Average Days Past Due

- Average Days Outstanding

- Reports to view Cash Inflow Detail

- Reason for Credit Issuance or Settlement

- Tracking Overall Credit Issuance by AR and Sales staff

- Analytics to view Accounts Receivable by staff member

- Waterfall analytics to view Accounts Receivable collection by company, territory, Sales Person.

- Know when, how and why you are getting paid

Why Do Organization Need this Functionality?

Knowing your projected cash receipts will help you plan for future purchases, and ensure you meet your corporate financial obligations.

How do you know when and what cash is going to be received? Although this is not a perfect science, and not withstanding other variables, your customer’s past paying behavior will determine when you are going to receive your cash (based on days that they have paid). All organizations depend on customer’s payments for product and services to exist and prosper. They need to know what their projected cash flow is to determine what their budget will be.

CollectSoft© has excellent view into your customers past payment behavior and cash payment analysis.

Is it economy or is it our customers?

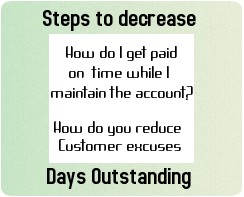

As economy began to take turn for the worse, we began to notice our cash inflow was getting smaller. Trying to meet our general expenses, we noticed delays of payment from our customers. Our account managers were attributing late pays due to economy; however, after analysis of our accounts receivable past history, we found that our customers were always late payers. What had changed was that our sales were reduced by a large margin, thus consistent cash flow was shrinking, and subsequently shrinking our reserves. We began to look for ways to decrease our days outstanding on our overall accounts receivable, which proved to be difficult for our business. Our customers had become acclimated to paying late, and determined if they couldn’t pay late, they might do business elsewhere. After much consideration, we found that our only alternative was to retrain our customers to pay by the due date.

This retraining required gentle reminders, maintenance of contracts, notes regarding their accounts, and consistent account updates. Giving access to Sales Managers, Project Managers to the Accounts Receivable also proved very beneficial, as they were aware of the customer’s status at all times and were able to work with them accordingly. Our software was key to this – enabling access, notes, and detailed reports from anywhere, with email and follow up capabilities.